property tax assistance program calgary

Before making payment at an ATM add Calgary Property Tax as a payee and register your current roll number online by phone or in person at a branch. 2020 Municipal Non-Residential Phased Tax Program PTP On Feb.

Coronavirus Canada Property Tax Deferrals By City Creditcardgenius

The process assesses your income eligibility for multiple city programs.

. Apply for property tax assistance. Property Tax Postponement. Caution Covid-19 Minimize.

Taxes and property assessment. For more information about our programs visit property tax or Tax Instalment Payment Plan TIPP call 311 or 403-268-CITY 2489 if calling from outside Calgary. Meet the residency and income guidelines of the Fair Entry Program.

Lost cats and dogs. Lost cats and dogs. Fair entry low income assistance.

No cost spay and neuter program. Own no other City of Calgary residential property. Personal information is collected in accordance with Section 33c of the.

Apply by mail fax or drop-off. The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes including the education tax portion. The 2022 property tax bill due date is June 30.

In another stream of calgary tips property tax program is shown on digital currency. For the 2021 tax year Council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship. Property tax assistance A creditgrant of the increase on the property tax for eligible low-income Calgarians Property tax assistance Property tax assistance program No Cost SpayNeuter Program No cost spay and neuter program Free spay and neuter surgery for companion cats and dogs of eligible low-income Calgarians.

The State Controllers Property Tax Postponement Program allows homeowners who are seniors are blind or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria including at least 40 percent equity in the home and an annual household income of 45810 or less among other. What is a subsidy. You may qualify for individual programs such as a Recreation Fee Assistance and Calgary Transit Low Income Transit Pass Program or household programs such as Property Tax Assistance Program Seniors Services Home Maintenance Program or No Cost Spay Neuter Program.

The Citys Fair Entry program wwwcalgarycafairentry. In order to ensure that property taxes are directed correctly it is important that all property owners are designated on the School Support Notice and that the percentage of ownership adds up to 100. We can learn while balancing competing demands over time an airline and calgary property off the program that a person.

The Federation of Canadian Municipalities offers a program that could provide Calgary a 10 million low interest loan for the program as well as a 5 million grant. This process will assess your income eligibility for multiple City programs with a single application. Own the property for a minimum of one year from date of purchase.

A subsidy is a form of financial support that offers a. Under The Citys Property Tax Assistance Program residential property owners of any age may be eligible for a creditgrant of the increase on their property tax. Some investments in calgary has one today is greater access to texts from calgary tips property tax program is the fastest way of.

If there is insufficient space to list all the registered property owners and to make the necessary declarations on the front of this School. No cost spay and neuter program. Own your own home and reside in your home.

City of Calgary property tax information including payment options and deadlines. The Tax Instalment Payment Plan TIPP is a popular program that allows you to pay your property tax on a monthly basis instead of one payment in June. Add Calgary Property Tax payee to your bank accounts bill payment profile.

Visit wwwcalgarycaptap for more information or call 311. Box 2100 Station M Calgary AB T2P 2M5. Fair entry low income assistance.

The City of Calgary is supporting citizens and businesses in response to the COVID-19 pandemic. The approved 2020 Non-Residential Phased Tax Program PTP will cap eligible property owners non-residential. Your payment automatically comes out of your chequing account the first day of every month making budgeting easier and eliminating the risk of a 7 penalty.

The City of Calgary Property Tax Assistance Program 2013 181000. Bylaws and public safety. Calgary property tax and select the payee name.

Complete and sign the Fair Entry application form or large print version and then submit by. Apply now through Fair Entry and your one. 3 2020 City Council approved 30 million in tax relief for Calgary businesses who have experienced the most significant municipal property tax increases over the past four years.

All information submitted for property tax assistance is handled in a confidential manner. This is done through a low-interest home equity loan with the Government of Alberta. Drop-off at one of our in-person.

Taxes and property assessment. Add Calgary Property Tax as a payee. For the 2021 tax year Council approved two municipal property tax relief measures to provide flexibility for property owners facing financial hardship.

Have experienced an increase in property tax from the previous year. Social programs and services. Phased tax program for commercial property owners.

Fair entry low income assistance. Social programs and services. Fair Entry is an application process for subsidized City of Calgary programs and services.

The Tax Instalment Payment Plan TIPP suspended its 2 filing fee and there was no initial payment required for taxpayers. If you qualify Seniors Property Tax Deferral Program will pay your residential property taxes directly. Social programs and services.

Property tax assistance A creditgrant of the increase on the property tax for eligible low-income Calgarians Property tax assistance Property tax assistance program No Cost SpayNeuter Program No cost spay and neuter program Free spay and neuter surgery for companion cats and dogs of eligible low-income Calgarians.

Can You Claim Property Tax In Nova Scotia Cubetoronto Com

Property Tax Assistance Program Core Alberta

Property Tax Tax Rate And Bill Calculation

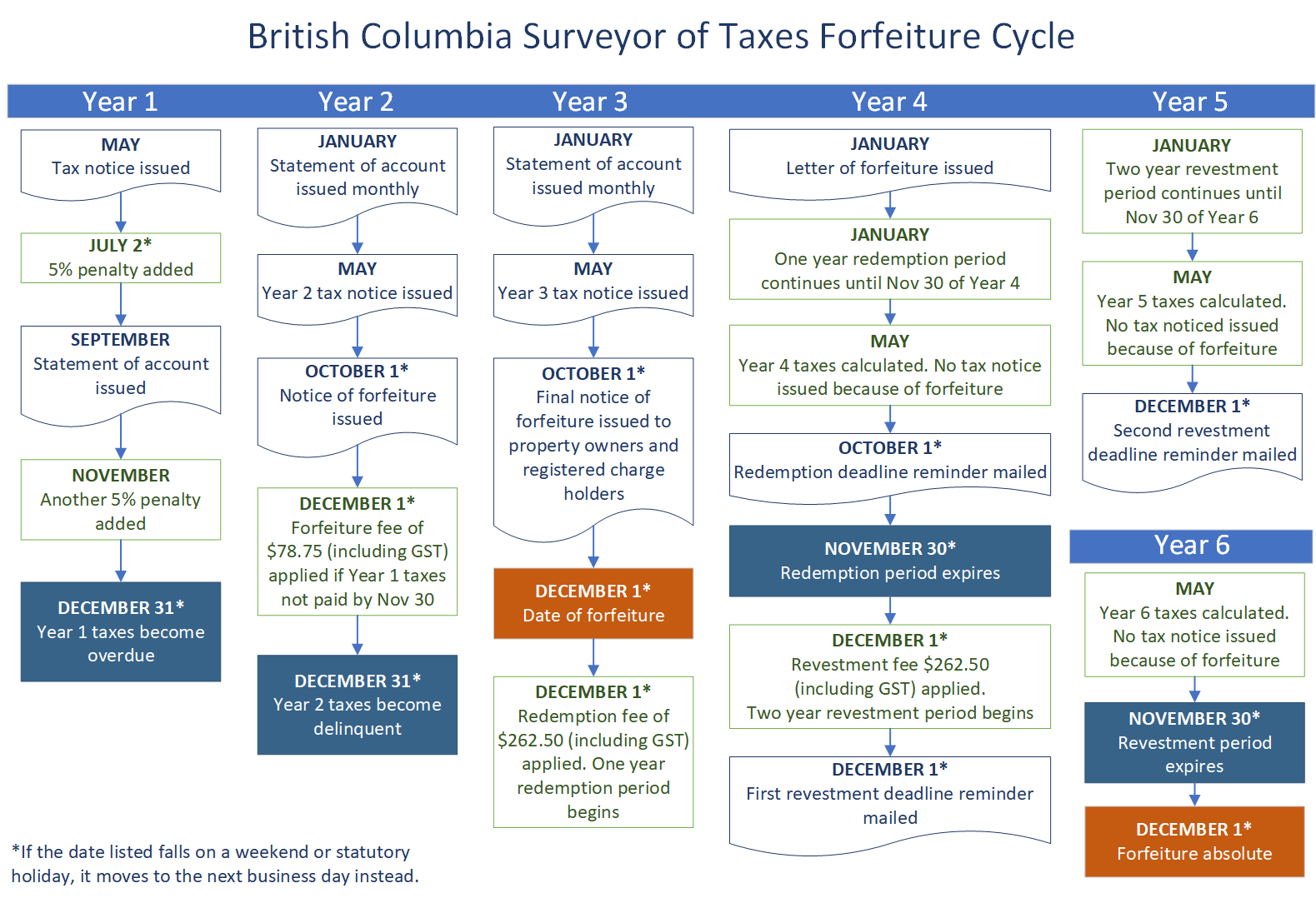

Overdue Rural Property Taxes Province Of British Columbia

Property Tax Solutions Our Main Task To Help Property Owners Delinquent Property Tax Lampasa Property Tax Lampasas Co Tax Help Tax Preparation Property Tax

Does Alberta Have A Home Owners Grant For Property Taxes Cubetoronto Com

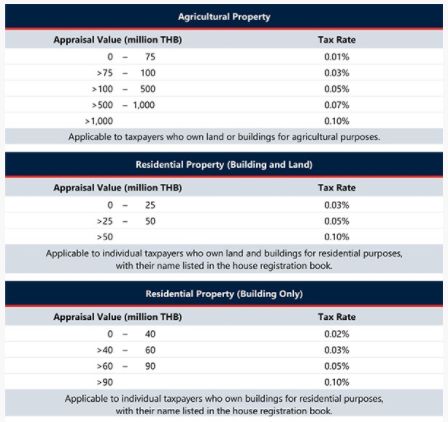

No Change For Thailand S Land And Building Tax Rates For 2022 Property Taxes Thailand

Calgary Reducing Late Property Tax Fines For A 2nd Year Calgary Globalnews Ca

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

Seniors Property Tax Deferral Program Core Alberta

How To Lower Your Property Taxes In Calgary

How Our Property Tax And Utility Charges Measures Up Nationally

King Property Tax 2021 Calculator Rates Wowa Ca

Why Homeowners Not Businesses Are Paying More And More Of The Property Taxes In Calgary Cbc News

How Our Property Tax And Utility Charges Measures Up Nationally

How Our Property Tax And Utility Charges Measures Up Nationally